Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

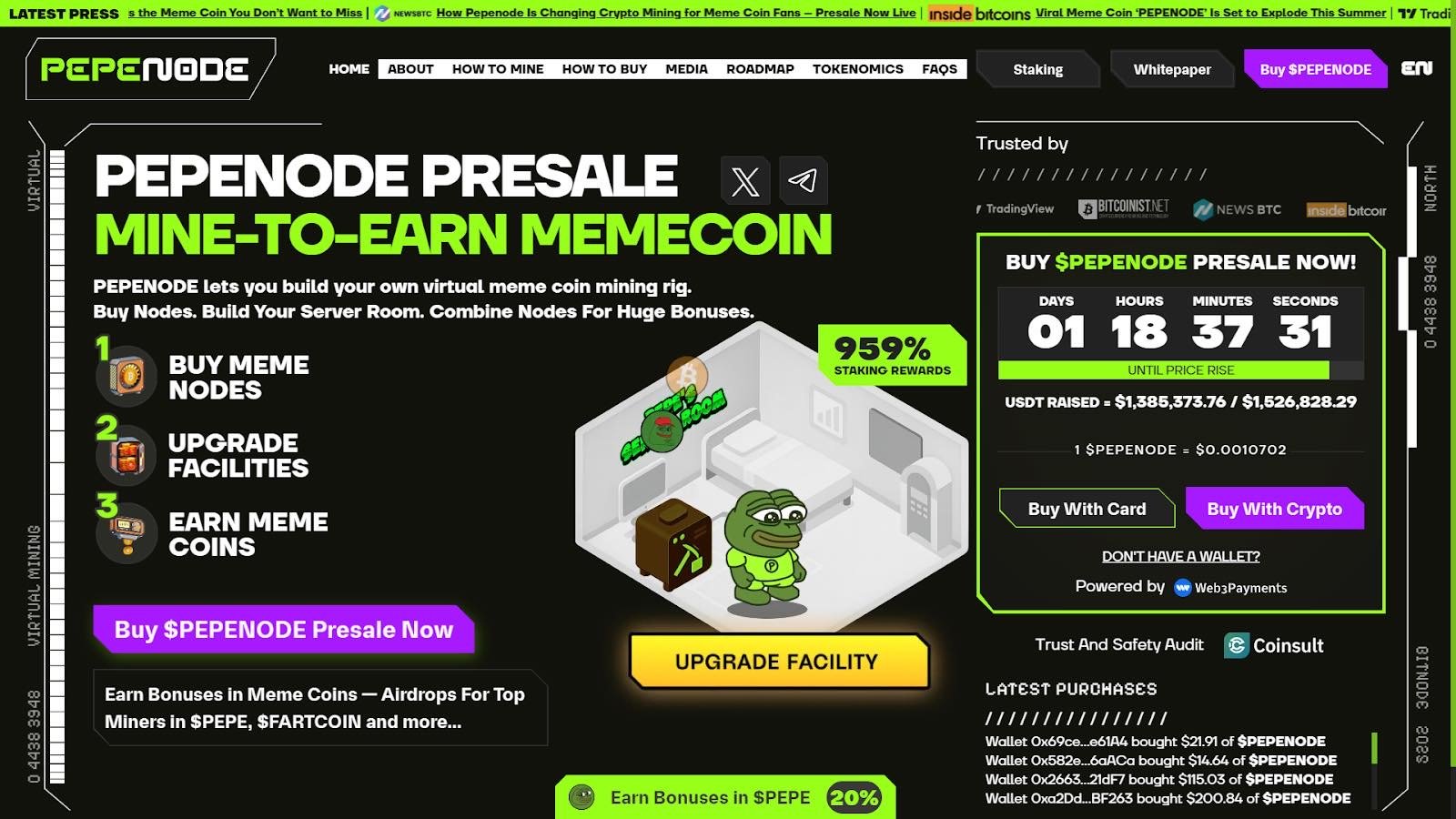

Staking Your Claim: Navigating the Wild World of Crypto Staking Systems

Dive into the thrilling realm of crypto staking! Discover expert tips and strategies to maximize your rewards and secure your digital assets.

Understanding Crypto Staking: How to Earn Passive Income

Crypto staking is a process that allows cryptocurrency holders to earn rewards by participating in the network's operations. Essentially, staking involves locking up a certain amount of cryptocurrency for a specified period in order to support the infrastructure of a blockchain protocol. By doing so, holders contribute to transaction validation and network security, which are essential for maintaining the integrity of decentralized systems. One of the most attractive aspects of crypto staking is the potential to earn passive income, making it an appealing option for investors looking to grow their digital asset portfolios.

In understanding crypto staking, it's also important to note the various factors that influence rewards. These may include the amount of cryptocurrency staked, the staking duration, and the specific protocol being utilized. Some platforms offer additional incentives, such as bonus rewards for longer staking periods or participating in governance. To maximize your earnings, it's crucial to research different staking options and choose the one that best fits your investment strategy. By doing so, you can effectively leverage your crypto holdings to generate a steady stream of passive income.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various scenarios. Players must work together to complete objectives or eliminate the opposing team. For those interested in gaming promotions, check out this rollbit promo code to enhance your gaming experience.

The Benefits and Risks of Staking Your Cryptocurrency

Staking your cryptocurrency offers several benefits that can enhance your investment strategy. Firstly, staking provides an opportunity to earn passive income, as stakers are often rewarded with additional tokens or coins in exchange for locking up their assets to support network operations. This process not only contributes to the security and functionality of the blockchain but also allows investors to potentially increase their holdings over time. Furthermore, staking can lead to lower transaction fees and a more active role in the governance of the blockchain, as many networks allow stakers to vote on important developments.

However, it is crucial to be aware of the risks involved in staking your cryptocurrency. One significant risk is the potential for loss of funds due to market volatility; if the value of the staked coins drops significantly, the overall investment could decline. Additionally, there are issues related to liquidity, as staked coins are often locked up for a specified period, limiting access to your funds when you need them. Finally, technical risks, such as bugs in the staking protocol or the possibility of hacks, can threaten your investment. Thus, it is essential to carefully evaluate these factors before committing to staking.

Step-by-Step Guide: How to Start Staking in Different Platforms

Staking has become a popular way for cryptocurrency enthusiasts to earn passive income. To kickstart your staking journey, it’s essential to choose a platform that aligns with your goals. Here’s a simple step-by-step guide to help you navigate different platforms:

- Research Different Platforms: Begin by exploring various staking platforms, such as Coinbase, Binance, and dedicated staking services like Kraken or BlockFi. Each platform will have unique offerings, fees, and rewards.

- Create an Account: Once you’ve selected a platform, sign up and complete the verification process, which may include providing necessary documentation to comply with regulations.

After setting up your account, it’s time to fund it and start staking:

- Fund Your Account: Deposit the cryptocurrency you wish to stake. Make sure to consider minimum staking requirements, as these vary across platforms.

- Choose a Staking Option: Navigate to the staking section and select your desired cryptocurrency to stake. Each option will likely have different expected returns and locking periods.

- Monitor Your Investment: After staking, regularly check your rewards and staking status. This will help you make informed decisions about your investments.