Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

On-Chain Transaction Analysis: Your New Crystal Ball into Blockchain Secrets

Unlock the secrets of blockchain with our on-chain transaction analysis! Discover insights that could change your crypto game forever.

Understanding On-Chain Transaction Analysis: Decoding Blockchain Activity

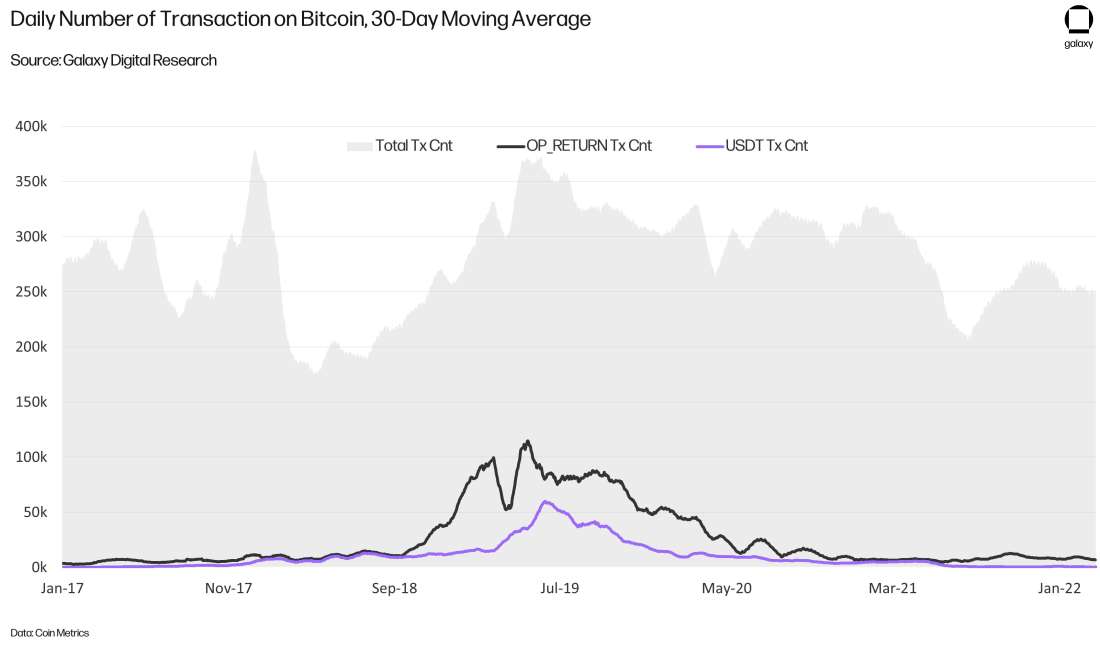

Understanding On-Chain Transaction Analysis is crucial for anyone looking to navigate the complex world of blockchain technology. This process involves examining the data stored on the blockchain to gain insights into transaction patterns, user behaviors, and network health. By analyzing on-chain transactions, individuals and organizations can identify trends, detect anomalies, and make informed decisions. Key components of on-chain analysis include tracking transaction volumes, studying wallet interactions, and assessing the flow of funds between different addresses.

One of the main benefits of decoding blockchain activity through on-chain transaction analysis is the transparency it offers. Unlike traditional financial systems, blockchain networks allow users to view transaction histories in a public ledger, enabling a higher level of accountability. Moreover, tools and software for on-chain analysis help in visualizing these transactions and provide a deeper understanding of market dynamics. As the blockchain ecosystem continues to grow, mastering on-chain transaction analysis will be an invaluable skill for crypto investors, developers, and regulators alike.

Counter-Strike is a highly popular first-person shooter game that has captivated players since its inception. The game emphasizes teamwork and strategy, allowing players to take on the roles of terrorists or counter-terrorists. For those looking to enhance their gaming experience, using a bc.game promo code can provide exciting bonuses and rewards.

Five Key Metrics to Analyze On-Chain Transactions Effectively

When analyzing on-chain transactions, it's crucial to focus on key metrics that can provide insights into network health and transaction efficiency. The first metric to consider is Transaction Volume, which indicates the total number of transactions processed within a specific time frame. A rising transaction volume typically signifies growing interest and activity on the blockchain. Next, Average Transaction Fee is important as it reflects the cost associated with processing transactions. Monitoring fluctuations in fees can help users understand network congestion and cost dynamics.

Another essential metric is the Confirmations Time, as it reveals how long transactions take to be confirmed. Faster confirmation times can enhance user experience, while excessive delays may indicate network strain. Additionally, tracking Token Transfers can provide insights into the movement of various digital assets, helping to identify trends in user behavior and liquidity. Finally, the Wallet Distribution metric should also be analyzed, as it shows the distribution of tokens among different wallets, indicating concentration or decentralization of asset ownership.

How Does On-Chain Analysis Uncover Cryptocurrency Trends and Patterns?

On-chain analysis plays a crucial role in uncovering cryptocurrency trends and patterns by examining data recorded on the blockchain. Unlike traditional market analysis, which often relies on price movements and trading volume, on-chain analysis focuses on metrics such as transaction volumes, active addresses, and the flow of coins between wallets. By aggregating and interpreting this data, analysts can identify emerging trends that may indicate market shifts or investor sentiment. For instance, a significant increase in the number of active addresses might suggest growing interest in a specific cryptocurrency, while substantial transactions from a wallet could signal the potential for price volatility.

Moreover, on-chain metrics can reveal underlying patterns that inform investment strategies. For example, studying the accumulation of coins by long-term holders can indicate confidence in a cryptocurrency’s future value, often leading to price increases. Conversely, if whales—large holders of cryptocurrency—begin to distribute their assets, it may hint at a bearish trend. Tools like Glassnode and Messari provide vital insights through visualizations and analytics, allowing traders and investors to make informed decisions based on these influential on-chain behaviors. As the cryptocurrency market continues to evolve, leveraging on-chain analysis becomes imperative for staying ahead of trends and maximizing investment potential.