Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

On-Chain Transaction Analysis: Peeking into the Blockchain's Crystal Ball

Unlock the secrets of blockchain with on-chain transaction analysis! Discover trends and predictions that can shape your crypto future.

Understanding On-Chain Transaction Data: Key Metrics and Tools

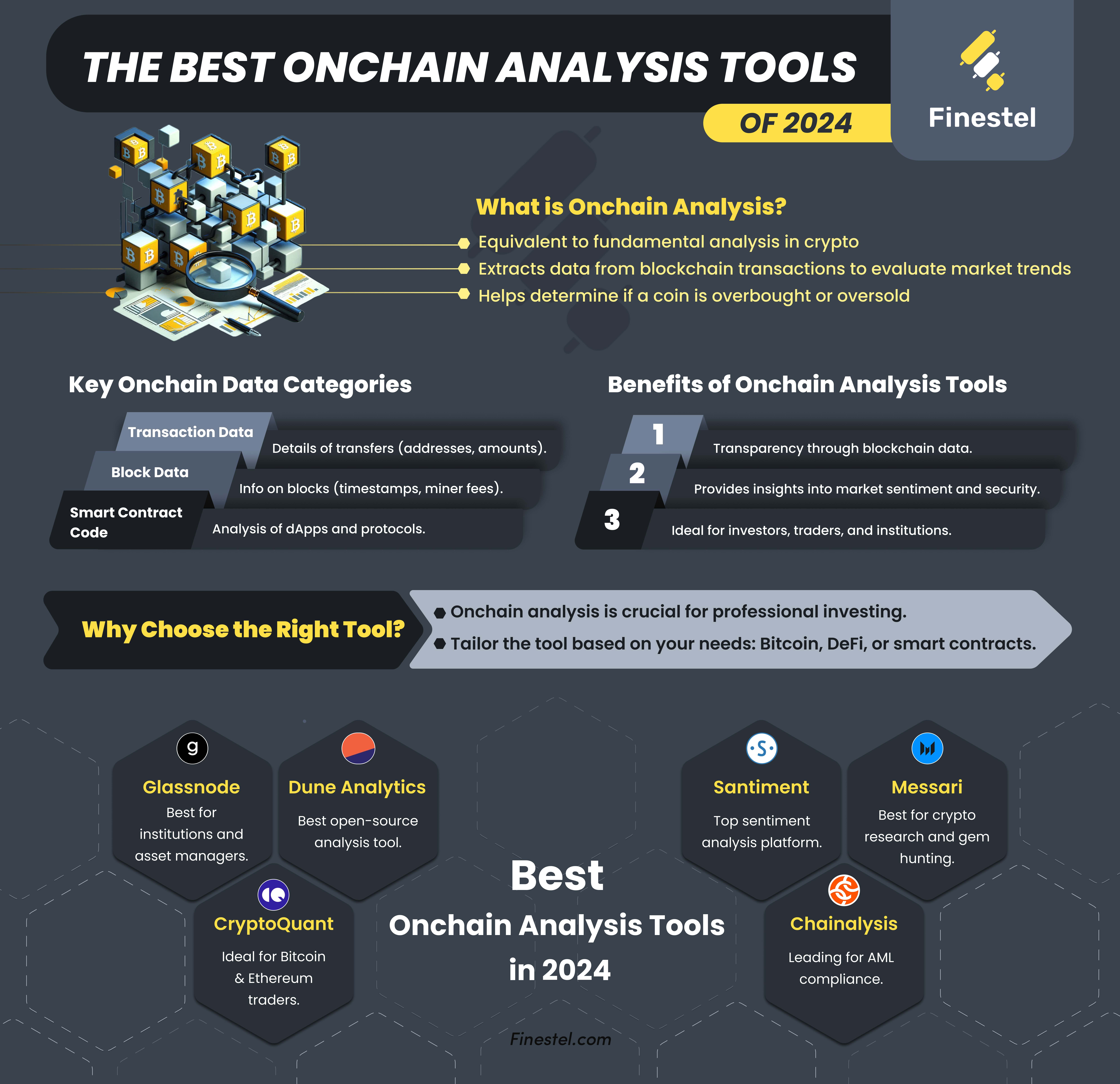

Understanding On-Chain Transaction Data is crucial for anyone involved in blockchain technology. On-chain data refers to all the information that is stored directly on a blockchain, including transaction details, asset ownership, and smart contract interactions. One of the key metrics to consider is the transaction volume, which indicates the number of transactions occurring over a specific period. This metric helps users gauge the network's activity and can highlight trends in usage. Additionally, average transaction fees provide insight into network congestion and demand for block space, aiding in cost management for users planning to transact.

To effectively analyze on-chain transaction data, several tools have emerged that cater to both novices and experts. Popular platforms like Block Explorer allow users to search for individual transactions, view historical data, and analyze wallets. Furthermore, advanced tools such as Glassnode and Token Terminal offer deeper insights into network health metrics, including active addresses and hash rates. Utilizing these tools enables investors and developers to make informed decisions and better understand the dynamics of their chosen blockchain networks.

Counter-Strike is a popular first-person shooter game that has captivated millions of players worldwide. Teams of terrorists and counter-terrorists compete in various game modes, strategically planning their moves to achieve victory. Players can enhance their gaming experience with unique promotions, such as using a bc.game promo code to gain access to exclusive rewards and advantages.

How On-Chain Analysis Can Predict Market Trends

On-chain analysis leverages blockchain data to provide insights into market behavior, making it an invaluable tool for predicting market trends. By examining transaction volumes, wallet activity, and historical price movements, analysts can identify patterns that suggest future price actions. For instance, an increase in large wallet transactions often indicates bullish sentiment among major investors, while a decline in daily active addresses may signal waning interest from retail investors. Analyzing these on-chain metrics allows traders to make informed decisions based on tangible data rather than speculation.

Additionally, on-chain analysis can help in understanding the overall health of the cryptocurrency market. By monitoring metrics such as network growth and transaction fees, investors can gauge whether the current market trend is sustainable. As an example, a rising number of new addresses joined with increasing transaction fees often points to a growing demand for the cryptocurrency, suggesting a potential bullish trend. Therefore, integrating on-chain analysis into market strategy not only enhances the ability to forecast price movements but also provides a robust framework for making sound investment decisions.

What Can On-Chain Transaction Patterns Tell Us About User Behavior?

On-chain transaction patterns provide a wealth of insights into user behavior within blockchain networks. By analyzing these patterns, we can discern various trends, such as user activity levels, spending habits, and preferences for certain types of assets. For instance, consistent transaction volumes and frequency can indicate a user’s engagement level, while large, sporadic transactions may reveal significant market moves or a reaction to external events. Furthermore, these patterns can help identify whether users are long-term investors or short-term traders, allowing for targeted strategies in marketing and user retention.

Moreover, understanding on-chain transaction patterns can have implications beyond individual user behavior. By aggregating data across multiple wallets, analysts can spot emerging trends in the market and predict future movements. For example, if a significant number of transactions are clustered around a particular token, it may signal a growing interest or a potential price surge. Additionally, tracking the flow of funds between different wallets can highlight the influence of key players, providing a fuller picture of the ecosystem at play.