Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

Term Life Insurance: Because You Can't Take It With You

Protect your loved ones and secure their future with term life insurance—because their peace of mind is priceless! Discover how today!

Understanding Term Life Insurance: Key Benefits and Features

Term life insurance is a popular choice for individuals looking to secure financial protection for their loved ones without the complexity of permanent policies. This type of insurance provides coverage for a specified period, typically ranging from 10 to 30 years, ensuring that beneficiaries receive a death benefit if the insured passes away during the term. One of the key advantages of term life insurance is its affordability; premiums are generally lower compared to whole life policies, making it an attractive option for families on a budget or those seeking pure life insurance coverage for specific financial obligations, such as a mortgage or education expenses.

Another notable feature of term life insurance is its flexibility. Policyholders can often convert their term policy into a permanent policy, providing an opportunity to adapt their insurance needs as their financial situation changes. Additionally, many insurers offer the option to customize coverage amounts and terms, allowing individuals to select a plan that aligns with their unique circumstances. Overall, understanding the key benefits and features of term life insurance can empower consumers to make informed decisions and secure the financial future of their loved ones.

Frequently Asked Questions About Term Life Insurance

Term life insurance is a popular choice for many individuals seeking financial security for their loved ones. One frequently asked question is, What is term life insurance? Simply put, it's a type of life insurance policy that provides coverage for a specific period, typically ranging from 10 to 30 years. If the insured passes away during this term, the beneficiaries receive a death benefit. However, if the term expires and the policyholder is still alive, the coverage ends without any payout. This feature makes it a more affordable option compared to permanent life insurance.

Another common question revolves around how much term life insurance do I need? The general guideline suggests calculating your coverage based on factors such as your current expenses, future financial obligations, and potential income loss for your family. Many experts recommend a coverage amount 10 to 15 times your annual income to ensure adequate protection. Additionally, consider your obligations, such as mortgage payments, children’s education costs, and outstanding debts, to determine the right amount of coverage for your unique situation.

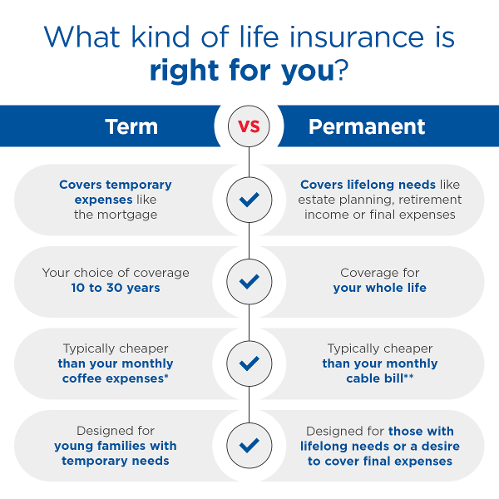

Is Term Life Insurance Right for You? An In-Depth Guide

When considering whether term life insurance is right for you, it's essential to evaluate your financial needs and goals. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. This type of insurance is generally more affordable than permanent life insurance, making it an attractive option for those seeking protection during critical financial years, such as while raising children or paying off a mortgage. To help determine if this type of policy suits your needs, consider the following questions:

- What debts do you have that would need to be covered in the event of your passing?

- Do you have dependents who rely on your income?

- How long do you anticipate needing coverage?

Another critical factor to consider is the benefit of affordability. Since term life insurance premiums are significantly lower than those of permanent insurance policies, they allow you to secure a substantial death benefit for a fraction of the cost. This can provide peace of mind knowing that your loved ones would be financially protected should the unexpected happen. Furthermore, many insurers offer the option to convert your term policy to a permanent one as your circumstances change, ensuring that you maintain coverage as your life evolves. Ultimately, deciding if term life insurance is right for you should hinge on your personal financial situation, future needs, and the level of security you wish to provide for your family.