Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

Insurance Smackdown: Comparing Quotes with Confidence

Unlock the secrets to saving on insurance! Compare quotes confidently and choose the best deal in our ultimate Insurance Smackdown!

How to Effectively Compare Insurance Quotes: A Step-by-Step Guide

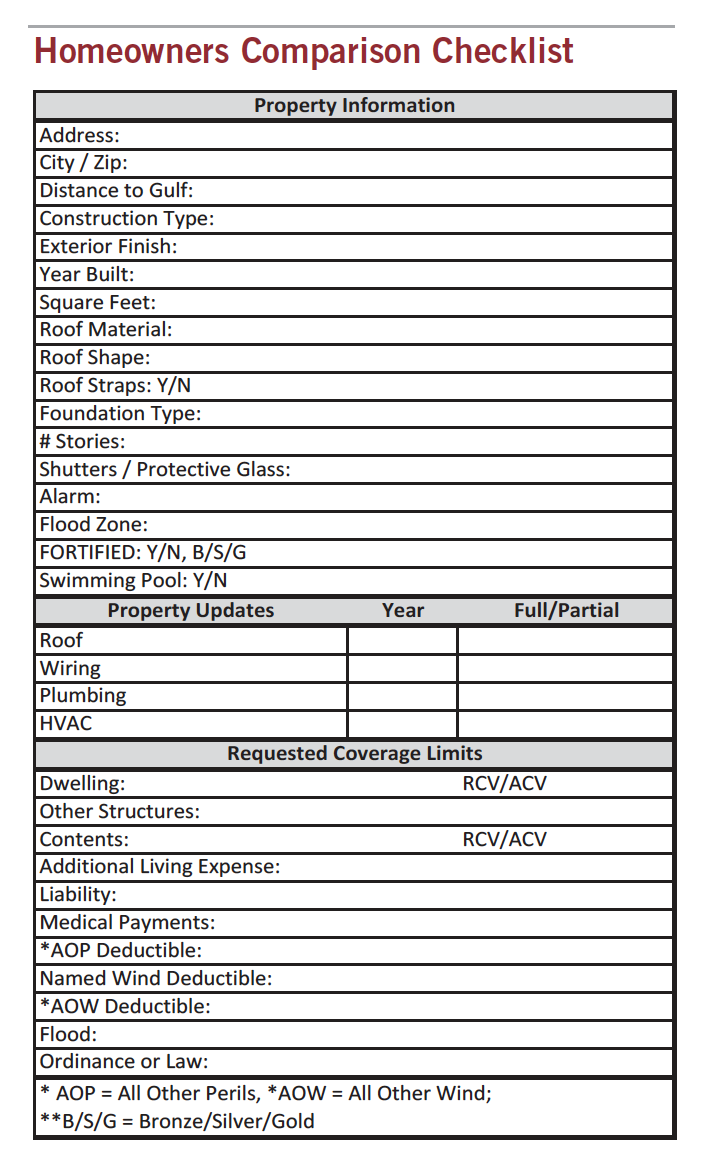

Comparing insurance quotes can be a daunting task, but with a methodical approach, you can find the best policy for your needs. Start by gathering quotes from multiple providers. To do this, you can use online comparison tools or contact insurance agents directly. Make sure to collect essential information including coverage limits, deductibles, and premiums. Tools like Insure.com can help streamline this process, making it easier to compare multiple options side by side.

Once you have gathered the quotes, the next step is to analyze them carefully. Create a comparison chart that lists the different policies along with their respective benefits and exclusions. Pay attention to customer reviews and claim handling reputation, as these factors are crucial for long-term satisfaction. Websites like Consumer Reports offer valuable insights into customer experiences, which can guide your decision-making process.

The Top 5 Factors to Consider When Evaluating Insurance Quotes

When evaluating insurance quotes, it is essential to consider several key factors that can significantly impact your decision. The first factor is coverage options. Different insurers offer varying levels and types of coverage, so it's important to ensure that the quotes you are comparing include similar benefits. This will help you to avoid underinsurance or overinsurance. The second factor is deductibles and premiums. A lower premium may seem appealing but could come with higher deductibles, which may lead to unexpected costs in the event of a claim. For more details on deductibles and premiums, check out this NerdWallet article.

Another crucial factor to evaluate is the financial stability of the insurance company. A company with a strong financial rating is more likely to honor its claims and provide reliable service. Resources like A.M. Best can give you insights into an insurer’s financial health. Additionally, consider the customer service reputation of the insurer; read reviews and look for ratings from independent organizations to gauge how well they handle claims. Finally, don’t forget to check discount opportunities that may apply to you. Many insurers offer discounts for bundling policies or having a safe driving record, which can make a significant difference in your overall costs.

Is Cheaper Always Better? Understanding the True Cost of Insurance Policies

When it comes to choosing insurance policies, the adage "cheaper is better" can often lead to misguided decisions. While lower premiums may seem appealing at first glance, the true cost of an insurance policy is determined by factors such as coverage limits, deductibles, and exclusions. For instance, a policy with a low premium might not cover essential services or may have high out-of-pocket costs when filing a claim. Understanding these nuances is crucial; therefore, it’s advisable to compare policies not just on price, but also on what they offer. For more insights, you can refer to Investopedia on how to effectively evaluate insurance policies.

Additionally, the reliability of the insurance provider plays a significant role in the overall value of a policy. A cheaper policy from a company with a poor reputation for customer service or claims handling can lead to frustration and unmet needs during a critical time. Always consider the financial stability and customer reviews of insurance companies before making a choice. Websites like Consumer Reports offer detailed assessments of various insurance providers, helping you make an informed decision. Remember, understanding the true cost of insurance goes beyond the initial price tag—it's about the full spectrum of coverage and peace of mind.