Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

Battle of the Policies: Finding Your Perfect Match

Discover the ultimate showdown of policies! Uncover insights to find your perfect match and make informed decisions today!

Understanding Policy Types: Which One is Right for You?

When it comes to selecting the right policy type, it's essential to understand the various options available. Policies can be broadly categorized into several types, including health insurance, life insurance, and auto insurance. Each of these categories serves a specific purpose and is designed to protect you or your assets under certain circumstances. Understanding how each type works and the unique benefits they offer can help you make an informed decision.

To determine which policy type is right for you, consider factors such as your financial goals, existing obligations, and overall risk tolerance. For instance, if you're starting a family, a comprehensive life insurance policy may be essential to secure your family's financial future. On the other hand, if you're seeking to safeguard yourself against medical expenses, exploring different health insurance options is crucial. Conduct thorough research and possibly consult with a financial advisor to align your choices with your personal situation.

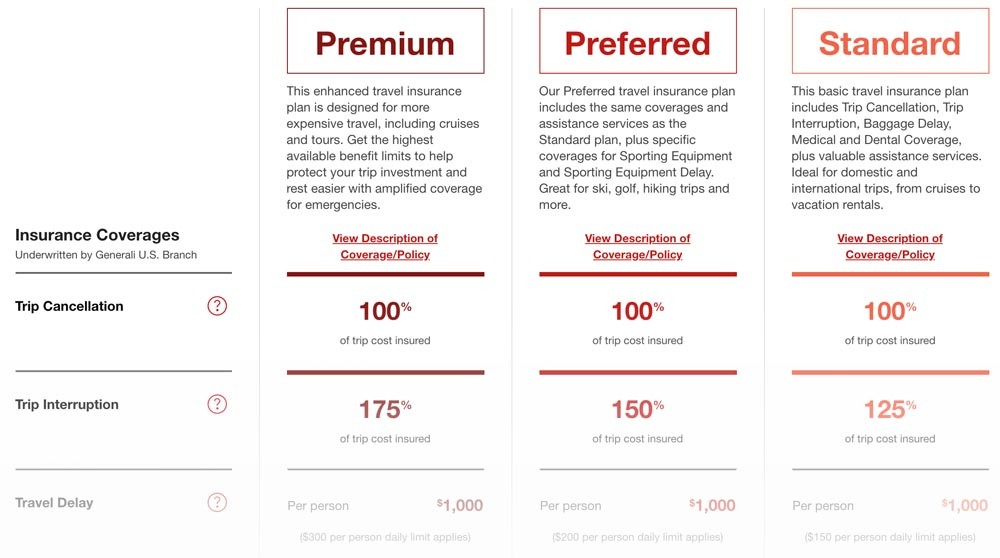

Comparing Policy Benefits: How to Choose Your Ideal Coverage

When it comes to choosing your ideal coverage, comparing policy benefits can help you make a more informed decision. Begin by identifying your specific needs, whether it's health, auto, or home insurance. Use a table format to create a visual comparison of key benefits offered by different policies. For instance, list the types of coverage, limits, deductibles, and any add-ons that suit your requirements. Resources like NAIC can provide reliable metrics to assess policy options effectively.

It's also essential to consider the claim process and customer support when comparing policies. Read reviews from current policyholders, and focus on their experiences regarding claims handling and responsiveness. You might want to create an ordered list of questions to ask insurance agents or customer service representatives. This list may include queries about waiting periods, exclusions, and how to file a claim. Websites like Consumer Reports offer valuable insights into customer satisfaction ratings that can guide your choice.

Key Questions to Ask When Evaluating Your Policy Options

When evaluating your policy options, it's essential to ask the right questions to ensure that the decisions you make are informed and beneficial. Start by considering the following key questions:

- What are the primary goals of the policy?

- Who will be impacted by these policies?

- What are the potential risks and rewards associated with each option?

- What evidence or data supports the effectiveness of the policy?

Furthermore, as you proceed with your evaluation, it's crucial to assess the feasibility of each policy option. Questions to consider include:

- What is the cost of implementing the policy?

- What are the administrative or logistical challenges involved?

- How does this policy align with existing regulations?