Aikido Insights & Community

Explore the art of Aikido and connect with enthusiasts.

Insurance Policies: The Hidden Lifesavers You Didn't Know You Needed

Discover the insurance policies that could save you when you least expect it. Protect your future today with these hidden lifelines!

Understanding the Fine Print: What Your Insurance Policy Really Covers

When it comes to understanding your insurance policy, the fine print can often feel overwhelming. This intricate detail contains crucial information about what your policy does and does not cover. Many policyholders assume that their insurance automatically protects them from every possible scenario, but that is rarely the case. Key exclusions and limitations listed in the fine print can leave you vulnerable, particularly when filing a claim. It's vital to thoroughly read this section, as it provides insight into how your coverage functions and informs you about the specific circumstances under which you might be protected.

Before signing on the dotted line, consider creating a checklist of essential elements to look for in your insurance policy. This should include:

- Coverage Limits: The maximum amount your insurer will pay for a covered loss.

- Deductibles: The amount you need to pay out-of-pocket before your coverage kicks in.

- Exclusions: Specific situations or items that are not covered by your policy.

- Additional Benefits: Extras that might be included, which can enhance your coverage.

By focusing on these elements in the fine print, you will have a clearer understanding of your insurance policy and be better prepared to navigate any potential claims.

5 Common Misconceptions About Insurance Policies Debunked

When it comes to insurance policies, many individuals hold misconceptions that can lead to poor decisions and inadequate coverage. One common myth is that all insurance policies are the same, which is far from the truth. Different policies cater to different needs, and understanding the specifics of each can save you money and provide better protection. For example, homeowners insurance typically covers more than just damage to your home; it may also include liability for accidents that occur on your property. It's crucial to carefully read and compare policy details before making a choice.

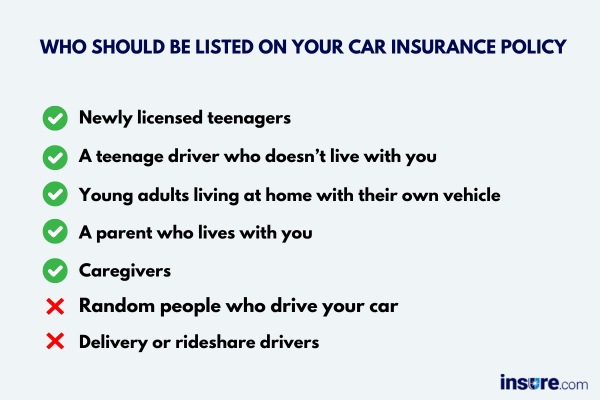

Another prevalent misconception is the belief that only the insured needs to be knowledgeable about their policy. In reality, having a good understanding of your insurance plan is essential for anyone involved, including family members. Whether it’s understanding what is covered under a life insurance policy or knowing how to file a claim for auto insurance, being informed helps ensure that beneficiaries are adequately covered in case of unexpected events. Open communication about insurance policies can lead to better preparedness and peace of mind.

Is Your Family Protected? Essential Insurance Policies You May Be Overlooking

When it comes to safeguarding your family's future, insurance policies often play a pivotal role. Many individuals focus on essential coverage such as auto and homeowner's insurance but overlook critical policies that can provide additional protection. For instance, life insurance is frequently discounted until it's too late, yet it can be invaluable in securing your loved ones' financial stability. In addition to life insurance, consider policies like disability insurance, which ensures that your family is supported even if you cannot work due to illness or injury.

Another frequently overlooked area is umbrella insurance, which provides an extra layer of liability protection above and beyond standard homeowner's or auto insurance. This can be especially crucial if you have substantial assets to protect or engage in activities that could lead to potential lawsuits. Additionally, don’t forget about critical illness insurance, which offers a payout in the event of severe medical conditions such as cancer or heart attack, easing the financial burden during difficult times. Taking a close look at these less considered insurance policies can be a smart move in ensuring that your family's well-being is comprehensively protected.